In Orange County housing, prices are inching up, days on market are stretching out, and interest rates are holding steady. We cover the highlights below and speculate on what it means for the year ahead.

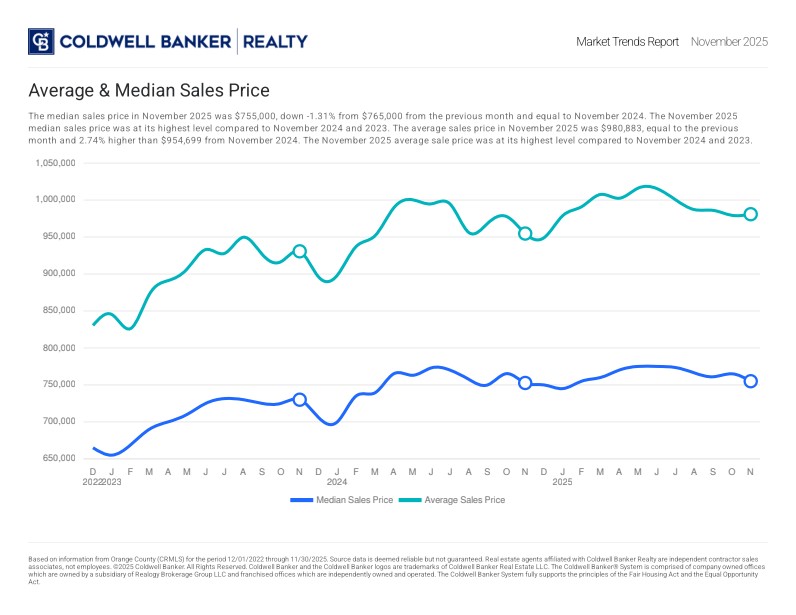

Home Prices: Up Slightly From Last Year

The average Orange County home sale price in November came in at $980,883, or about 2.75% higher than a year ago. It’s not the rapid appreciation we saw in 2021 or early 2022, but it does show that demand is still very much alive, especially for well-priced homes in desirable pockets of the county.

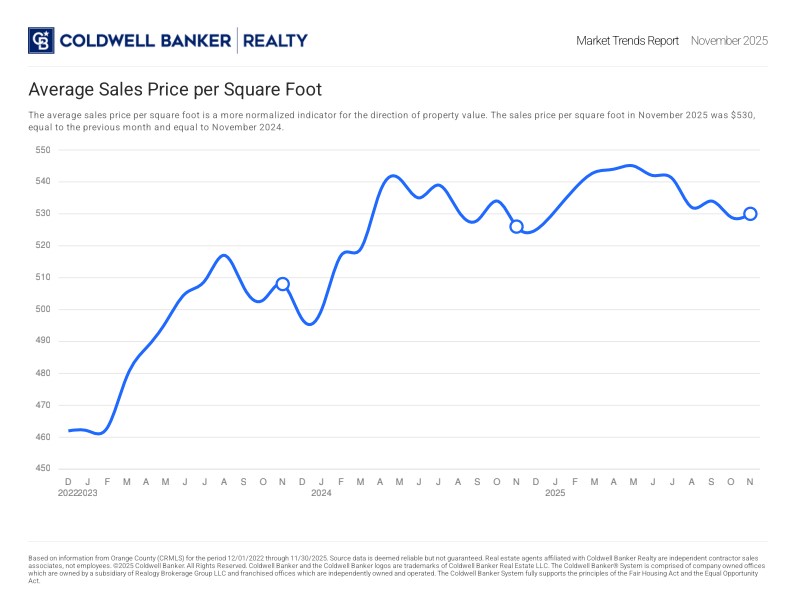

Price per square foot tells a more muted story. At $530, it’s basically identical to both last month and last November. That stability suggests we’re not in a price spike or a price slide, just a steady, slow-moving market where buyers are selective and sellers are adjusting expectations.

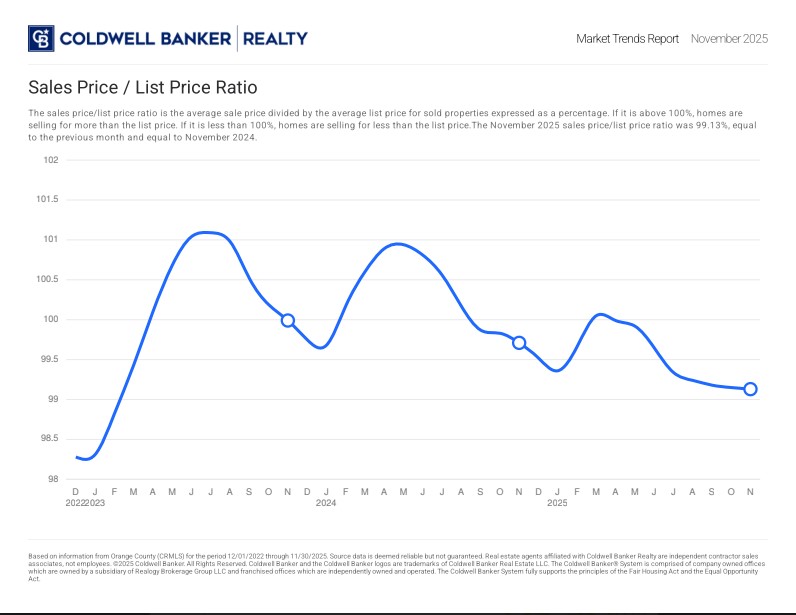

Sales Price to List Price: Holding Strong

Homes sold for 99% of the list price, right in line with last month and last year. For sellers, this means pricing strategy still matters. Buyers aren’t wildly overbidding, but they’re also not demanding sweeping discounts unless a home has been sitting or is priced above the market.

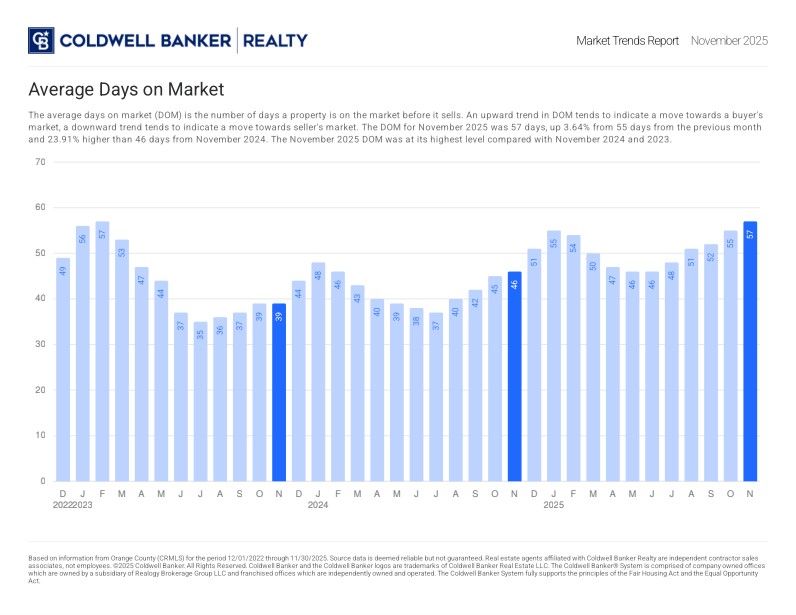

Days on Market: Rising, But Still Seller-Friendly

The average days on market hit 57, the longest we’ve seen in a couple of years. That might sound like a major slowdown, but by historical standards this still qualifies as a slight seller’s market.

What this really reflects is a return to normalcy. Homes aren’t selling in a weekend, but they are selling, especially if they show well and are priced right.

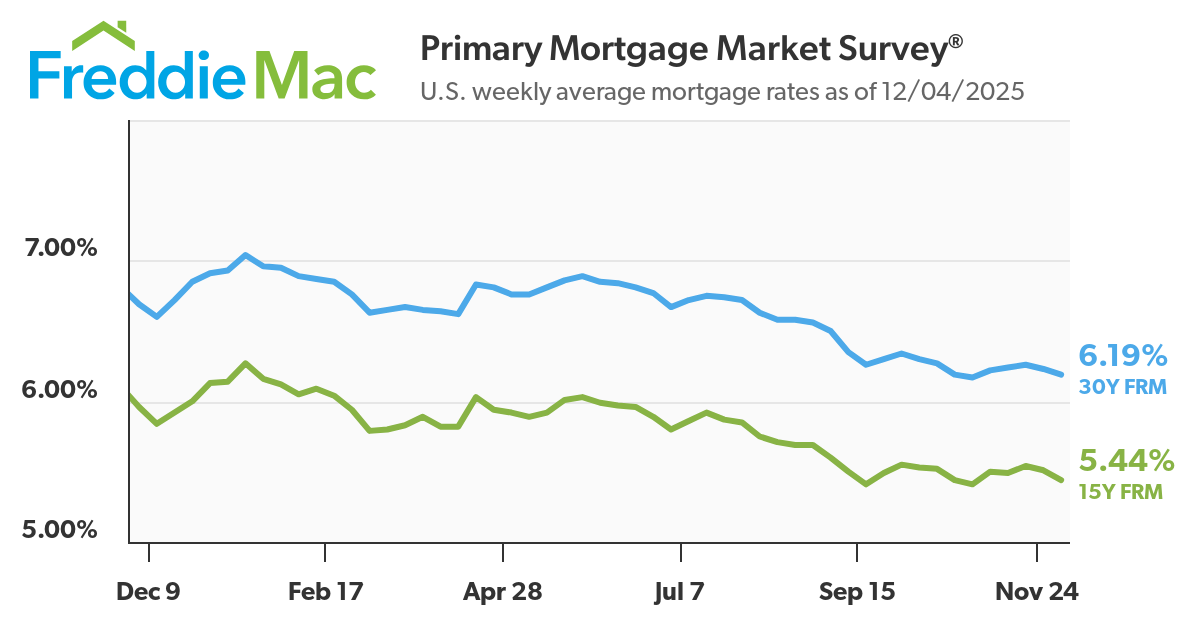

Interest Rates: Staying low for a longer period

Mortgage rates have been holding at or below 6.5% for the past three months. The last time we saw sustained rates below 6.5% for the fall / winter was September-November 2021.

The difference of course is that prices are much higher now and rates were much lower then (in the 3% range). So, while lower rates are helping to steady the market, they aren't pushing prices up like they did in 2021.

Prediction for 2026

To see a real shift in sales and prices in 2026 we think rates would need to dip below 6% and stay there for a few months. We're closer now than we have been in years, but for now, slow growth is where we are. If rates start to dip in the spring below 6% like they were in spring of 2021 and 2022, we could see prices and sales move more quickly than in 2025.