Mortgage rates have been stubbornly high in recent history, often hovering above the 7% mark, but recent shifts suggest this year is different.

What’s actually happening with mortgage rates right now?

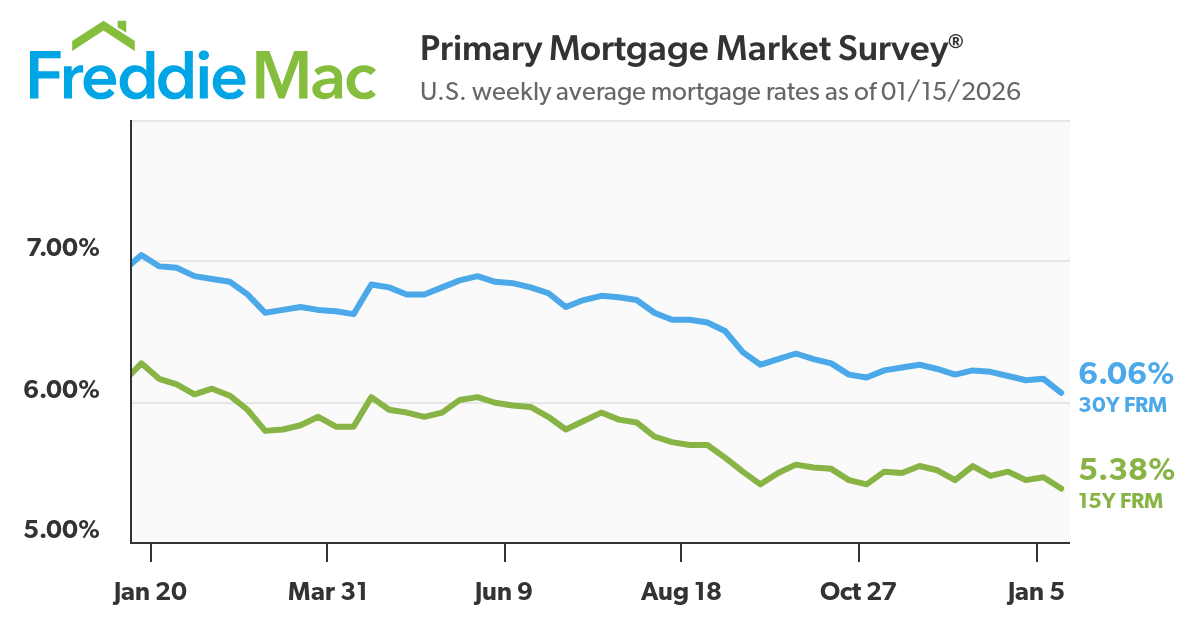

The benchmark 30-year fixed mortgage, the gold standard for most homebuyers, dipped to 6.06% according to Freddie Mac, the lowest reported average in over three years. Earlier this week, mortgage data company Optimal Blue reported that rates hit 5.99%!

The benchmark 30-year fixed mortgage, the gold standard for most homebuyers, dipped to 6.06% according to Freddie Mac, the lowest reported average in over three years. Earlier this week, mortgage data company Optimal Blue reported that rates hit 5.99%!

For context, in 2023, the same average rate was 7.79%.

Why are rates dropping now?

After a series of cuts by the Federal Reserve to its benchmark rate last year, interest rates on longer-term loans like mortgages have gradually eased as Treasurys and bond yields have come down. Lower yields tend to pull mortgage rates along with them.

Recently, the Trump administration's announcement of federal purchases of mortgage-backed securities appears to be nudging yields lower still.

What this means for buyers and homeowners:

Homebuyers see more purchasing power when rates dip. The difference between 7.79% and 6.06% translates into about $575 in monthly savings or over $200K over the course of a 30-year fixed home loan. That matters in Orange County where average home prices are over $1 million.

For homeowners or potential sellers, the easing of rates helps reduce the lock-in effect, that phenomenon where homeowners with low rates won't sell because they’d have to take a much higher current rate. The lower this effect, the more likely a move makes sense for more homeowners.

What buyers should do next

Buyers can take advantage of lower rates by:

Asking their lender for rate options that might be meaningfully better than the national average.

- Recalculating their approval numbers with the change in rates.

- Considering different loan structures like adjustable-rate mortgages or buydown strategies if your plans are flexible.

Bottom line: Whether you’re a first-time buyer or a homeowner looking to move up or down, lower rates can mean the difference between waiting and acting. Reach out to us today to get off to a great start to 2026.