December is always a strange month for real estate. Activity slows, headlines get quieter, and most people are mentally checked out, thinking more about holidays and New Year’s resolutions than open houses. That’s exactly why December data is so useful: it strips away some of the noise and shows us what the market looks like when only motivated buyers and sellers are left standing.

Here’s what December 2025 tells us about the Orange County housing market and what it may be whispering about 2026.

A Market That’s Officially Balanced

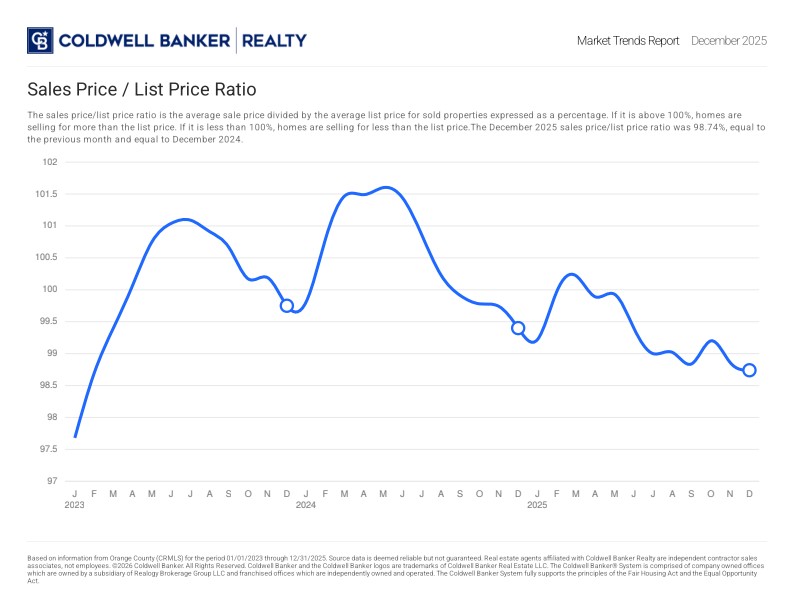

The December 2025 sales price-to-list price ratio came in at 98.74%, essentially unchanged from November and about 1% lower than December 2024. Translation: homes are selling close to asking price, but not above it. This is classic balanced market behavior—neither side has a clear upper hand, and pricing discipline matters again.

That balance is showing up consistently across multiple metrics, which makes this signal more meaningful than a single month’s blip.

Sales Volume: A Quietly Encouraging Sign

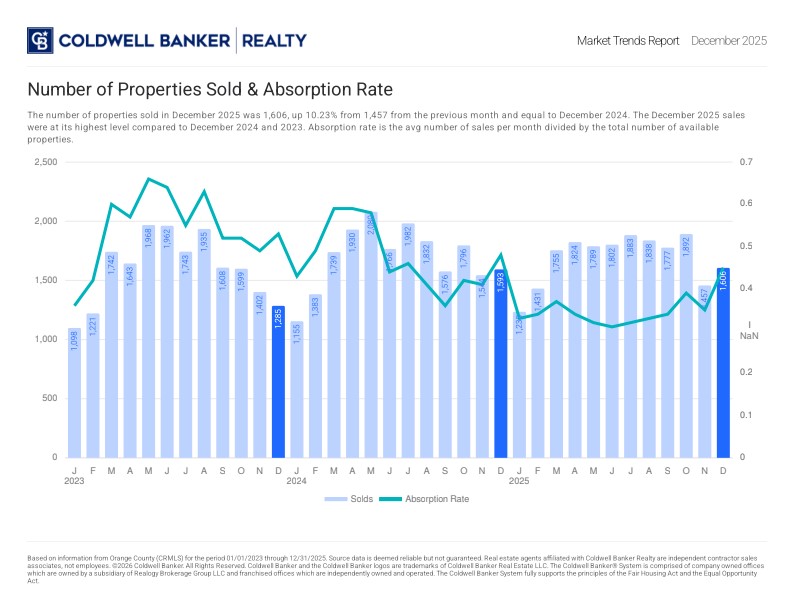

A total of 1,606 properties sold in December, up 10.23% from November and just above December 2024. More importantly, this was the strongest December performance compared to both 2024 and 2023.

December rarely breaks sales records, beating the prior two years suggests buyers didn’t disappear at the end of 2025. That’s a small but meaningful vote of confidence heading into 2026.

Days on Market: Slower, But Not Sluggish

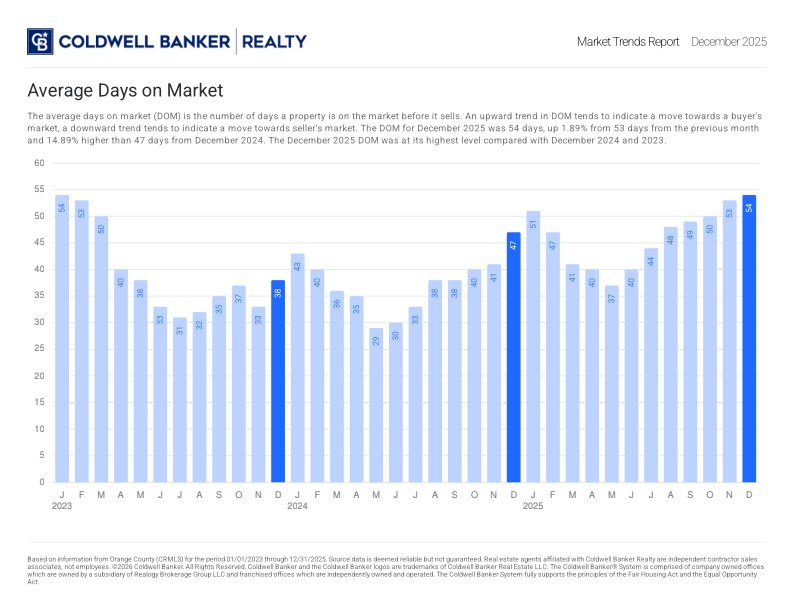

Homes spent an average of 54 days on market, up slightly from November and nearly 15% higher than December 2024. This is the longest December average we’ve seen in the past three years.

Longer days on the market don’t automatically mean weakness. In this case, they reinforce the idea of balance: buyers are taking more time, sellers are negotiating more, and the market is behaving more rationally. At this pace, a true buyer’s market still looks like a stretch without a major external shift.

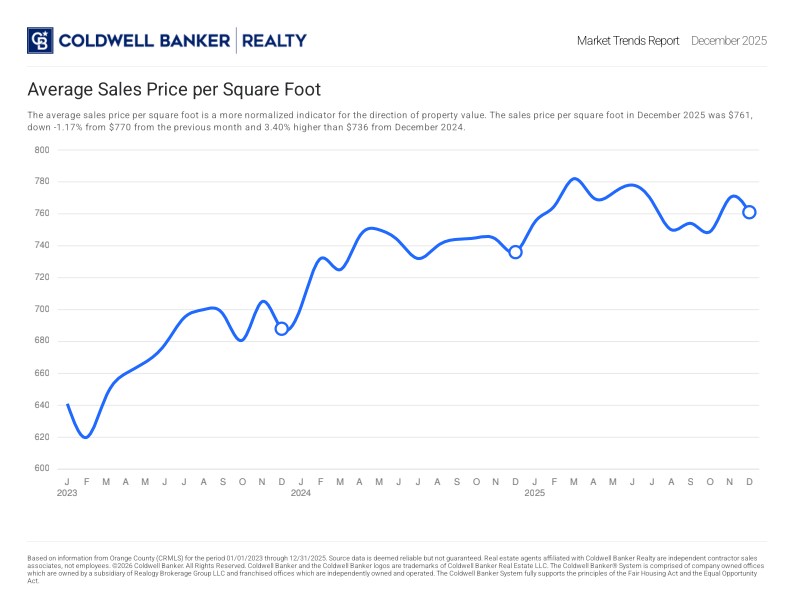

Price Per Square Foot: Normal Seasonal Cooling

The sales price per square foot was $761, down about 1.17% from November, which is completely normal for December. Compared to last year, prices are still up 3.40%, roughly in line with inflation.

That matters. It suggests prices aren’t surging but they aren’t eroding either. Instead, values are holding steady in real (inflation-adjusted) terms, which is exactly what you’d expect in a market that’s finding its footing rather than racing ahead.

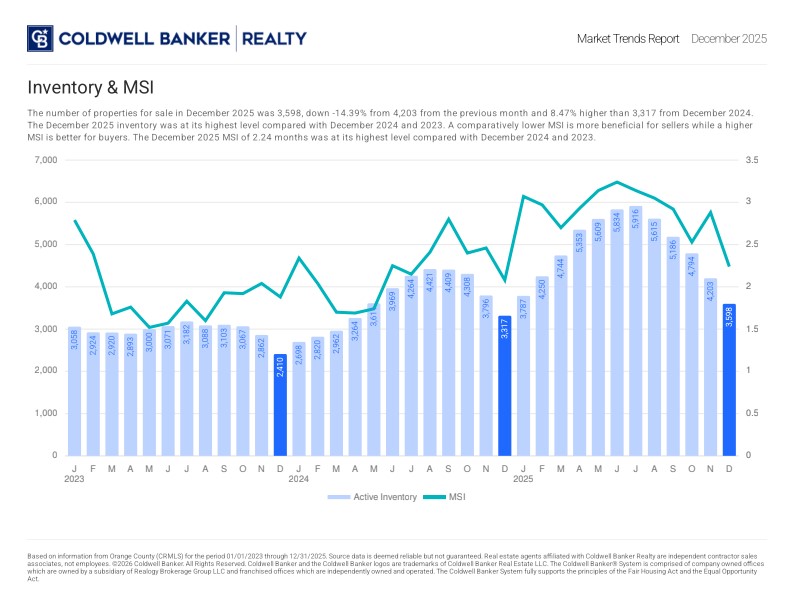

Inventory: Higher, But Still Historically Tight

There were 3,598 homes for sale in December, down sharply from November but 8.47% higher than last year. While this was the highest December inventory level compared to 2024 and 2023, it’s still low by historical standards.

In other words, buyers have more options than they did a year ago but not enough to fundamentally tip the scales.

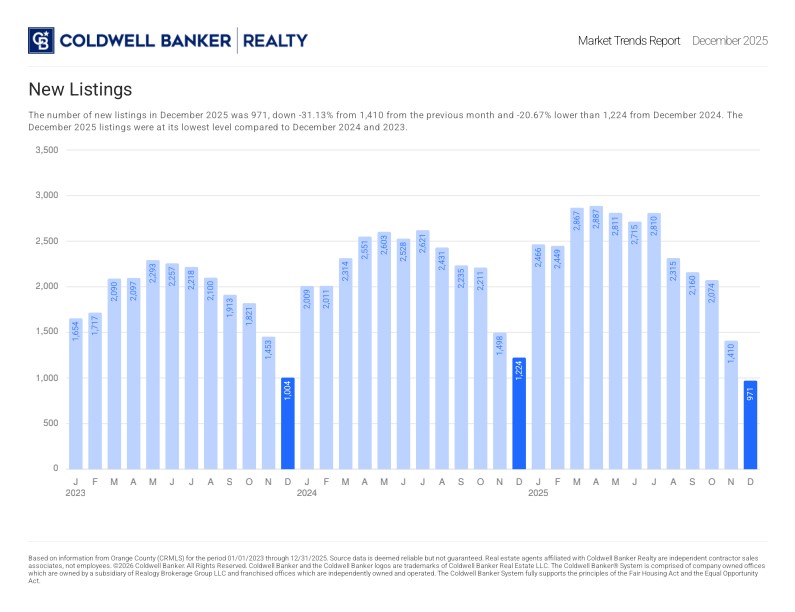

New Listings: The Quiet Story That May Matter Most

Only 971 new listings hit the market in December, down over 31% from November and more than 20% lower than December 2024. This was the lowest December new-listing count in three years.

This trend matters. Fall and winter listing activity has been shrinking year over year, and if that continues into early 2026, we could see a stronger spring seller market than we saw in 2025, simply because supply never fully reloads.

A New Year, New Resolutions, Even If You Don’t Call Them That

January has a funny way of sneaking big decisions in through side doors. Not everyone writes down resolutions, but many people quietly decide to simplify, downsize, move closer to family, reduce expenses, or finally act on a plan they’ve been circling for years.

The December data fits that mindset. This isn’t a market fueled by urgency or fear. It’s a market shaped by intentional decisions. Buyers are deliberate. Sellers who price realistically are still getting results. And the people entering the market now tend to have strong “need-to” reasons rather than casual curiosity.

Bottom Line

December 2025 closed the year with a housing market that looks stable, balanced, and patient. Prices are steady, sales are holding, inventory is modestly higher, and new listings are tight. That combination doesn’t point to fireworks but it does suggest a market quietly setting the table for 2026.

Sometimes the most important months aren’t the loud ones. They’re the calm ones that tell you what’s likely to happen next.